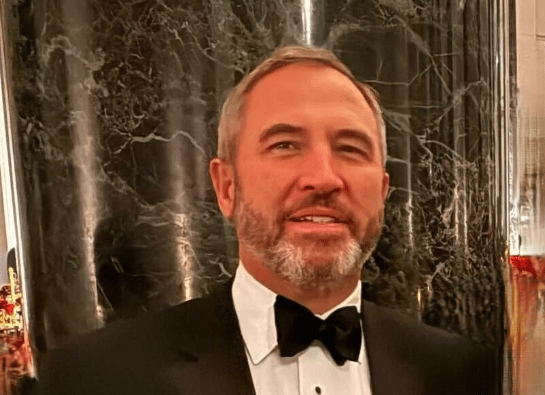

Brad Garlinghouse didn’t come out of Silicon Valley with grandiose assertions or sudden fame. Rather, he took a methodical but incredibly successful approach, gaining knowledge, honing his intuition, and putting himself in a place where change is subtly occurring. Garlinghouse, who has an estimated net worth of $10 billion, has not only survived the cryptocurrency’s ups and downs but has become one of its most enduring figures.

His early interest in computers was sparked by his upbringing in Topeka, Kansas. His early interest ultimately prompted him to pursue an MBA from Harvard and a career in economics. But he was looking for relevance, not prestige. His career choices suggested a man motivated by the texture of the work rather than by title. The internet was still unstructured and unreliable when he relocated to Silicon Valley. Instead of simply riding a wave, he learned how to control it.

| Name | Brad Garlinghouse |

|---|---|

| Born | 1971, Topeka, Kansas |

| Current Role | CEO of Ripple Labs |

| Estimated Net Worth | $10 billion (as of March 2025) |

| Key Assets | 6.3% Ripple stake, personal XRP holdings |

| Known For | “Peanut Butter Manifesto” at Yahoo, Ripple-SEC legal battle |

| Reference |

He received his first big stage from Yahoo. His “Peanut Butter Manifesto,” a daring internal wake-up call that claimed the corporation had been overstretching itself, was written there while he was Senior Vice President. The connection was compelling, and the wording was remarkably clear. The majority of business memos disappear into inboxes, but this one turned into a parable, an uncommonly direct criticism from someone who isn’t scared to face lethargy.

Crypto was still experiencing an identity crisis when Garlinghouse acquired Ripple in 2016. Was there money involved? Was that code? Or chaos masquerading as creativity? He didn’t waste his time philosophizing incoherently. Rather, he presented Ripple as a platform that is especially useful for international transfers where traditional finance faltered. He prioritized practicality over theory. That decision molded Ripple’s character. It molded his, too.

Through strategic alliances, he extended Ripple’s reach throughout the banking sector. Deals with American Express, Santander, and Japan’s SBI Holdings gave the company a distinctive credibility. Yet, Ripple came under increased scrutiny as it became more legitimate.

Ripple was charged by the SEC in 2020 with making an unregistered securities offering. According to the complaint, since 2013, XRP sales have raised more over $1.3 billion. Garlinghouse pushed back instead of settling quickly or withdrawing into silence. He presented the legal case as an examination of antiquated frameworks trying to regulate new systems. This became a referendum on the future of cryptocurrency in regulated markets rather than just a lawsuit.

The case continued for almost five years. The allegations were officially withdrawn by the SEC on March 19, 2025. The following day, XRP surged beyond $2.50 before marginally declining. Kraken reports that it ended at $2.42. The surge was not just symbolic; it had a seismic effect on the economy.

Garlinghouse’s net worth increased, and he now owned roughly 6.3% of Ripple and a sizeable XRP holdings. Garlinghouse is currently among the wealthiest people in America, according to Charles Gasparino, who reported via X. In contrast to many computer billionaires who indulge in bombast, Garlinghouse maintained a remarkable level of composure, preferring quiet contemplation to revelry.

He never completely shifted his attention to money. He was still focused on Ripple’s goal. He frequently used the term “internet of value,” implying that international money transfers will be as smooth as email. He stressed integration over disruption in interviews, including a recent appearance on CNBC. “The goal is not to displace conventional finance,” he stated. “It’s about making it much more efficient, inclusive, and quick.”

Notably, Garlinghouse downplays the urgency of a Ripple IPO but hasn’t ruled it out. His optimism isn’t without merit, though. His voice has become more clear as regulatory discussions heat up, urging American lawmakers to enact regulations that prevent innovation from being forced abroad.

He said during a Senate hearing in July 2025 that consumers and reputable cryptocurrency players had suffered as a result of unclear frameworks. He stated, “At Ripple, we witnessed firsthand how ambiguous regulations can be weaponized to target good actors.” The statement was made without resentment. It was more of a subdued challenge, a reminder that progress necessitates clarity rather than turmoil.

Garlinghouse has been remarkably steady throughout. He doesn’t follow fashion. He creates structure. While others made lofty declarations about decentralization or moonshots, he concentrated on making the value case of cryptocurrency very evident, particularly to regulators, bankers, and regular users.