Temu’s quick growth has been a very successful strategy for attracting analysts’ and consumers’ attention. Launched in 2022 under PDD Holdings, it has already surpassed Amazon to become the world’s second most popular shopping site—an accomplishment that seemed unthinkable only a few years ago. Its site received 2.1 billion visits in June 2025 alone, and its monthly active user base now exceeds 416 million. These numbers are remarkably clear indicators of its momentum.

Amazon, on the other hand, continues to dominate due to its financial power and infrastructure. Its dominance is incredibly resilient, with $574 billion in revenue and a market valuation of $1.5 trillion. Since Temu’s shipping is still largely dependent on fulfillment in China, it has not yet been able to match its highly efficient logistics system, which can deliver same-day or next-day across large regions. For many customers, that dependability is a must, and Amazon’s speed difference is noticeably faster.

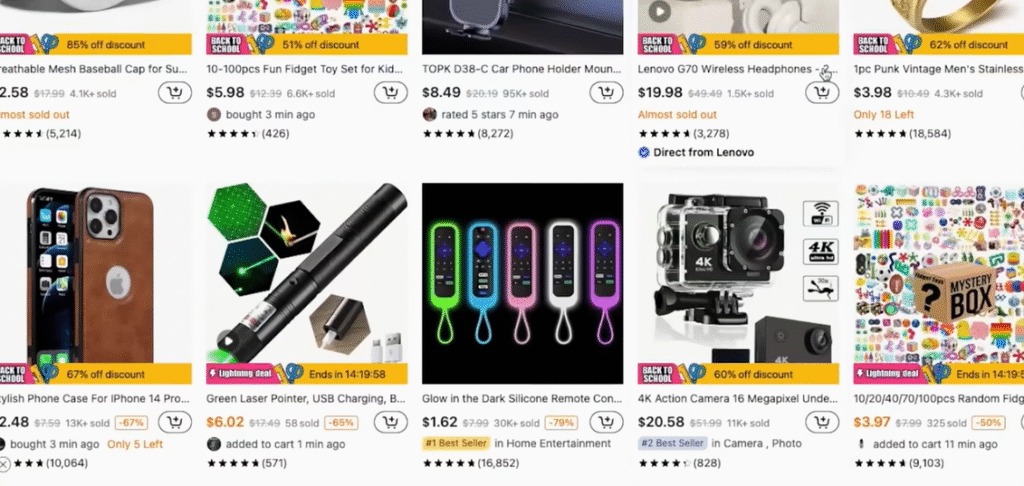

Nevertheless, Temu’s disruptive approach and Shein’s fashion achievements are remarkably similar. Temu eliminates the middleman by putting customers and manufacturers in direct contact, resulting in surprisingly low prices. This is demonstrated by the $6.99 hammock on Temu, which could cost four times as much on Amazon. Temu becomes more than just a store; it becomes a symbol of thrift and exploration, especially for consumers who are feeling the pinch of inflation.

Comparison of Temu vs. Major E-Commerce Giants (2025)

| Platform | Founded | Parent Company | Valuation/Revenue (2025) | Monthly Active Users / Visits | Core Strengths | Notes |

|---|---|---|---|---|---|---|

| Temu | 2022 | PDD Holdings | $128.7B (parent value); GMV ~$40.9B | 416M monthly users; 2.1B visits | Low-cost pricing, gamified shopping | Growing fast, app-driven, heavy focus on discounts |

| Amazon | 1994 | Amazon Inc. | $1.5T valuation; $574B+ revenue | 2.7B monthly visits | Logistics, Prime shipping, AWS cloud | Global leader, diversified ecosystem |

| Shein | 2008 | Private | ~$100B estimated | 250M+ app downloads; 150M+ users | Fast fashion, direct-to-consumer model | Strong Gen Z appeal, sustainability concerns |

| Walmart (E-Com) | 2000s | Walmart Inc. | $460B+ total retail revenue | 500M+ site visits | Grocery strength, hybrid retail model | Strong U.S. brand trust, omnichannel advantage |

| TikTok Shop | 2023 | ByteDance | Part of $268B ByteDance | 47M U.S. shoppers; millions global | Shoppertainment, influencer marketing | Extremely popular, faces U.S. regulatory challenges |

The closest spiritual parallel to Temu is still Shein. Fast fashion was the foundation of Shein’s $100 billion empire, but Temu has since grown into a variety of industries, including electronics, home goods, and cosmetics. Both benefit greatly from extremely low prices and a steady stream of new products. Temu sets itself apart, however, by gamifying the shopping experience and incorporating fun incentives that turn perusing into a kind of group amusement. This strategy is especially creative because it keeps users interested for longer than many of its competitors.

The situation is further complicated by TikTok Shop. Its combination of algorithmic targeting and influencer-driven sales results in a highly adaptable type of business that is frequently referred to as “shoppertainment.” In this regard, Temu’s emphasis on gamification and inexpensive shipping seems to fit in with the larger movement that shopping is becoming more than just a practical activity. Notably, users now perceive Temu’s app scrolling as similar to TikTok streaming—each action yields a tiny dopamine reward, turning shopping into a habit.

Another powerful force is Walmart’s online store. Walmart, which receives over 500 million visits every month, combines the ease of online shopping with the security of physical storefronts. Its hybrid business model has proven especially resilient, particularly in the grocery industry, which Temu does not yet control. Temu dazzles with prices, but it still battles doubts about the quality of its products. Walmart’s strength is brand trust. The problem is very obvious: Temu needs to increase its credibility in order to keep up with its user base.

Temu has already started to change perceptions on a cultural level. Its “Shop Like a Billionaire” Super Bowl ad was incredibly successful at fostering a lighthearted and welcoming atmosphere. The brand was swiftly adopted by influencers, who used unboxing videos to promote TikTok and Instagram and normalize cheap shopping. For young, tech-savvy customers, Temu is more than just a store—it’s a lifestyle symbol thanks to this celebrity-driven cultural capital.

Temu has political obstacles. Its use of the U.S. de minimis rule, which permits duty-free entry for shipments under $800, is being questioned. Lawmakers contend that although these loopholes are very effective for consumers, they harm domestic manufacturers and retailers. Any change to customs laws could significantly lessen Temu’s price advantage, requiring it to change its approach. However, its quick investments in regional warehouses in North America and Europe point to a practical shift toward long-term robustness.

The effects on society are multifaceted. On the one hand, Temu gives low-income families more financial flexibility by democratizing access to goods. However, there are still issues with labor and sustainability. Its 17.5 million tree plantings as part of its partnership with Trees for the Future are seen as a step in the right direction, but detractors contend that these actions pale in comparison to the environmental costs of mass shipping. Temu’s legacy will be determined by how well it strikes a balance between responsibility and growth.